Building Australia Model

Australia’s pool of superannuation savings is ready to be deployed for major infrastructure projects to protect and grow the retirement savings of fund members, help create thousands of jobs and kick-start the economy following the COVID-19 pandemic.

How do we see the problem?

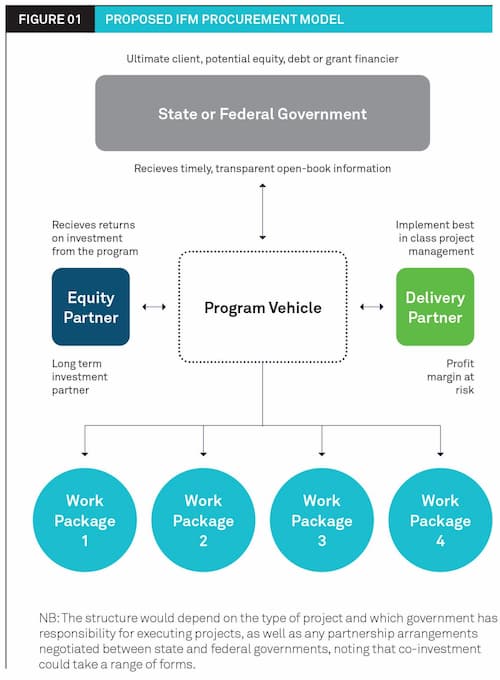

The current procurement model for large infrastructure projects is not working as well as it could be. This is because it relies on attracting large contractors whilst limiting the role for local medium-sized contractors and long-term equity owners. When things go wrong with construction, equity providers are passive.

This effectively transfers construction and budget risk back to governments, and is resulting in substantial delays and cost overruns in some large projects. Furthermore, bidding consortia tend to be dominated by participants that exit and earn their profits shortly after construction is complete. They have little if any interest in the infrastructure asset’s long-term operational performance and outcomes for the public. IFM Investors and industry super funds are reluctant to invest on these terms, as we don’t think it’s in the interests of industry super fund members or in the public interest.

Meet the author

Related articles

Repowering renewables

Economic Update June 2024