Industry trends: Increasing scope for public private partnerships to build back better through infrastructure

Multiple disruptions are shaping the infrastructure sector, including the global net zero focus, funding shifts driven in part by government stimulus packages and digital transformation. In our Infrastructure Outlook report we highlight some of the areas that we believe investors will hear a lot about. This article details one of those areas – the role of infrastructure in government COVID recovery plans.

Infrastructure investment is playing a key role in supporting national recovery plans through generating economic and jobs growth, while also delivering infrastructure communities need.

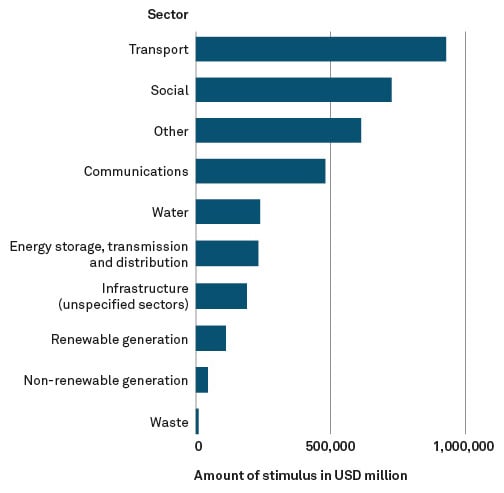

Governments have announced an estimated US$3.2 trillion allocated to infrastructure globally as part of COVID-related stimulus (see Figure 1)1, and while much of this will be delivered through public grant funding and traditional contracting, we also see significant opportunities for governments to partner with the private sector – particularly long-term, responsible investors like superannuation and pension funds – to deliver infrastructure that is transformational for communities and economies.

Source: https://transformativeinfratracker.gihub.org/overview

Figure 01 Infrastructure as a stimulus by sector - G20 spend 1

The scale of the infrastructure task is substantial, particularly in the United States (US). Private investment in US public infrastructure has lagged behind other countries as infrastructure projects have traditionally been funded with government grants and financed through the issuance of municipal bonds, with little scope for the private sector to invest and partner with governments to deliver public infrastructure more efficiently and at a lower whole-of-life cost. This has remained true even as there are record levels of dry powder among equity investors looking to put capital to work in infrastructure.

The scale of the infrastructure task is substantial, particularly in the United States (US). Private investment in US public infrastructure has lagged behind other countries as infrastructure projects have traditionally been funded with government grants and financed through the issuance of municipal bonds, with little scope for the private sector to invest and partner with governments to deliver public infrastructure more efficiently and at a lower whole-of-life cost. This has remained true even as there are record levels of dry powder among equity investors looking to put capital to work in infrastructure.

With President Biden signing the Infrastructure Investment and Jobs Act into law, the federal government has formally recognised and encouraged the role of the private sector in helping governments close the infrastructure investment gap. The Biden Administration plans to spend an incremental US$284 billion on transportation, including roads, bridges, rail, public transit, airports, ports and electric vehicle infrastructure. Another US$266 billion is earmarked for enhancing core infrastructure including power grid, broadband, water and environmental resiliency/remediation3. The private sector will have many opportunities to participate in the buildout of this infrastructure; as well as potentially invest equity (given how substantial the planned incremental spending is) as many state and local infrastructure needs may remain unmet.

In addition, the Act introduces new measures, which encourage states and local governments to consider alternative infrastructure procurement models such as public-private partnerships (PPPs or P3s) when determining how to finance infrastructure. These measures may work to elevate the profile of PPPs and start the national conversation on alternative infrastructure procurement models, which may include long-term leases of infrastructure or asset recycling opportunities.

The provisions in the Inflation Reduction Act, previously contained in the unsuccessful Build Back Better Act**, could be even more directly consequential in boosting equity investment opportunities through its extension and expansion of tax incentives for investment in renewable energy projects

European governments are also turning to the private sector to help deliver their sustainable infrastructure agenda. The European Green Deal – which provides a blueprint for the world’s first climate-neutral continent - seeks to mobilise at least €1 trillion in sustainable investments through a mix of public and private sources.4

On a smaller scale, as Australia looks towards a federal election in 2022, both major parties have policies that seek to catalyse private investment in the post-COVID recovery, clean energy and the commercialisation and development of technologies that are likely to be critical to the net zero transition5. An example of this kind of partnership can be drawn from IFM’s experience working with Australian federal and state governments on projects that upgrade and expand the existing transport, defence, education and justice PPP assets it manages. Currently IFM is working with the Federal Government to facilitate a major upgrade of Defence’s Joint Headquarters facility. The project will support the doubling of the facility’s original capacity and create a 1.9 megawatt solar farm, among a range of other benefits.

More broadly, the Australian Government is planning to invest A$250 million in its new future fuels policy and hopes to stimulate another A$250 million in private investment6. It has also committed to provide the Clean Energy Finance Corporation, Australia’s public green bank, with A$500 million in additional capital for a Low Emissions Technology Commercialisation Fund, which will seek matching investment from the private sector.7

Increasing opportunities for PPPs is one of the four key trends and disruptions shaping we identified as shaping the sector in our Infrastructure Outlook. Check out the full report.

1 Between February 2020 and August 2021. Source: https://transformativeinfratracker.gihub.org/overview/

2 MISSING

4 https://ec.europa.eu/commission/presscorner/detail/en/ip_20_17

5 At the time of writing, 1 March 2022

6 www.pm.gov.au/media/driving-consumer-choice-uptake-low-emissions-vehicles

7 www.pm.gov.au/media/billion-dollar-fund-drive-low-emissions-technology-investment

This article is Part Four of a four-part series of excerpts from our Infrastructure Outlook Report, which highlights some of the areas that we believe investors will hear a lot about. This article details one of those areas – the role of infrastructure in government COVID recovery plans.

Related articles

Repowering renewables

Economic Update June 2024