Economic Update December 2019

Economic outlook is anything but 20-20

The past year was characterised by a global slowdown precipitated by increasing geopolitical uncertainty and heightened trade frictions. Central banks responded with coordinated monetary easing that buoyed equity markets despite the softening economic fundamentals. However, with monetary policy already nearing its limits, the efficacy of further cuts has been questioned with many central banks calling for fiscal policy-makers to open the taps and support growth. Fiscal stimulus will likely not be forthcoming and the outlook for 2020 continues to be soft with risks appearing tilted to the downside.

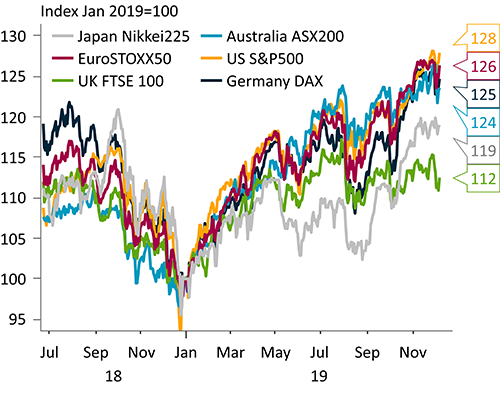

Global: Key developed markets equity performance

Equity markets were choppy in late 2019 but finished strong

Despite the uncertainty, several key global equity markets are heading into the final month of the year at or near fresh record highs. This performance comes just a few months after bond markets rallied and priced in peak levels of pessimism.

Reading these dynamics together, it feels like the year can be adequately described as one in which there was plenty to be concerned about, but investors do not want to miss out on any market rally, and they are confident central banks will keep the stimulus coming.

Meet the authors

Related articles

Repowering renewables

Economic Update June 2024